Sales Surge in Citrus Craze

The United States Department of Agriculture (USDA) forecasts a substantial increase of 225 thousand metric tons (MT) in global lemon and lime production for the 2023/24 season. Despite declines in production from Mexico and the United States (US), higher outputs from the European Union (EU), South Africa, and Turkey contribute to this surge.

Lime prices in the US market have surged by 16% in W1, signaling ongoing challenges within the Mexican supply chain. Factors such as aging trees, diseases in nurseries, and adverse weather conditions in Veracruz have disrupted Mexican fruit supply, particularly impacting sizes 110 and 150, leading to limited availability and higher prices. To stabilize the supply chain, producers are closely monitoring weather patterns while large retailers are diversifying their sourcing regions, with Colombia emerging as a significant lime supplier to the US market.

Demands and Consumption Trends

Lemons and limes are witnessing a notable rise in demand and consumption. Per capita consumption is expanding, buoyed by increasing imports and moderate retail growth. Cassie Howard, senior director of category management and marketing at Sunkist Growers Inc., notes a significant uptick in lemon and lime demand, with lemon volume up by 30% and lime demand soaring by 45% compared to the pre-COVID season.

Lemon Leap

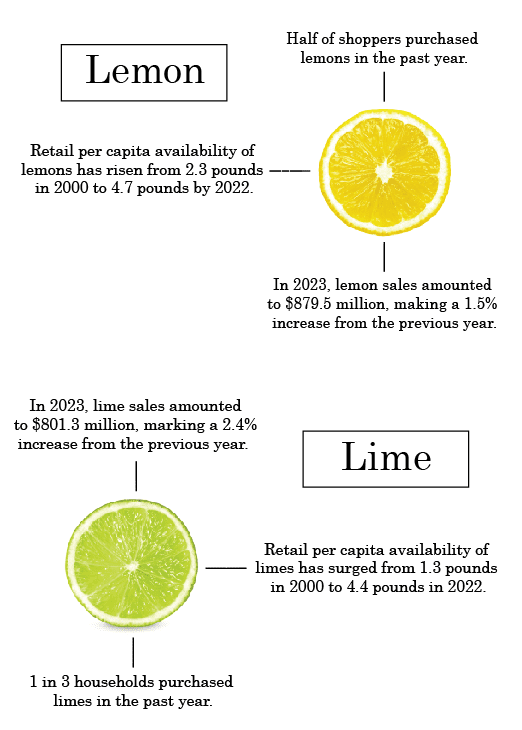

Over the past two decades, there has been a doubling in retail per capita availability of lemons, rising from 2.3 pounds in 2000 to 4.7 pounds by 2022. Total retail lemon sales for the 52-week period ending Jan. 28 amounted to $879.5 million, marking a 1.5% increase from the previous year. Volume sales increased by 2.6% during this period, with a marginal decline in average price per pound.

The Fresh Trends 2024 survey indicates that nearly half of shoppers reported purchasing lemons in the past year, with households with an annual income over $100,000 comprising the highest percentage of lemon purchases. Similar to lime trends, households with children, consumers aged 40-49, and Hispanic consumers reported significant lemon purchases.

Limes Rising

Retail per capita availability of limes has surged from 1.3 pounds in 2000 to 4.4 pounds in 2022, driven predominantly by imports. Total dollar sales of limes for the 52 weeks ending Jan. 28 were $801.3 million, marking a 2.4% increase compared to the previous year. However, organic lime sales experienced a slight decline while conventional lime sales rose. Volume sales for all limes increased by 7.6% during this period, with a 4.8% decrease in price per pound compared to the previous year.

The Packer’s Fresh Trends 2024 survey reveals that one in three consumers purchased limes in the previous 12 months, with households with an annual income over $100,000 reporting the highest percentage of lime purchases. Additionally, Hispanic consumers and households with children also reported significant lime purchases.

Trade Flow

US exports of fresh lemons declined by 12% in 2023, totaling $134.3 million, while imports of lemons and limes rose by 11% to $1.01 billion. Mexico remains the top supplier for the lemon/lime citrus category, followed by Colombia, Argentina, Chile, and Peru.

These trends underscore the dynamic shifts within the global lemon and lime market, driven by changing consumer preferences, supply chain challenges, and evolving trade dynamics.

In conclusion, the global lemon and lime market is experiencing a significant increase in production for the 2023/24 season. Despite declines in Mexico and the US. Supply chain challenges, particularly in Mexico, have led to a surge in lime prices in the US market, prompting producers to monitor weather patterns closely and retailers to diversify sourcing regions. Rising demand for lemons and limes, driven by increasing imports and moderate retail growth, reflects changing consumer preferences, while trade dynamics continue to evolve, with Mexico remaining the top supplier in the citrus category.

Your Freight, Our Connection